When it comes to the Indian financial market, one name that’s been generating a lot of buzz lately is Jio Financial Services. As a key player in the financial sector, Jio Financial Services is poised to make a significant impact, especially given its strong backing from Reliance Industries. Investors and market analysts are closely watching the Jio Financial Services share price and are eager to see how it performs in a rapidly evolving market.

This article will delve into the factors influencing the share price, recent trends, and what investors can expect in the near future. Whether you’re a seasoned investor or new to the stock market, understanding the dynamics behind Jio Financial Services’ stock is crucial for making informed decisions.

What is Jio Financial Services’ Share Price

As of September 4, 2024, Jio Financial Services’s share price is ₹347.20. The stock has seen a 52-week high of ₹394.70 and a low of ₹204.65. The company has a market capitalization of approximately ₹2.2 lakh crore. Despite a high price-to-earnings (P/E) ratio of 143.82, which is significantly above the sector average of 17.11, Jio Financial Services has shown strong financial performance, with a recent net profit of ₹1,604.55 crore.

Jio Financial Services is a non-banking financial company (NBFC) that is part of the Reliance Group. Through its subsidiaries, it offers various financial services, including payments, insurance broking, and lending.

1. Understanding Jio Financial Services: Company Background

1.1 The Evolution from Reliance Strategic Investments to Jio Financial Services

Jio Financial Services (JFS) was initially incorporated as Reliance Strategic Investments Private Limited in July 1999. Over the years, the company has undergone several transformations, with the most significant being its rebranding and restructuring into Jio Financial Services. This evolution marks a strategic shift by Reliance Industries to consolidate its financial services under one robust entity, targeting various segments, including payments, lending, and insurance.

1.2 Jio Financial Services’ Core Business Segments

JFS operates primarily through its subsidiaries, including Jio Payments Bank, Jio Insurance Broking Limited, and Jio Finance Limited. These subsidiaries cater to different aspects of the financial services spectrum:

- Jio Payments Bank: Focuses on providing digital payment solutions.

- Jio Insurance Broking Limited: Offers insurance products and broking services.

- Jio Finance Limited: Provides lending and credit services to individuals and businesses.

This diversified portfolio allows Jio Financial Services to capture a significant market share in India’s growing financial services sector.

1.3 Market Position and Competitive Landscape

In the highly competitive Indian financial services industry, Jio Financial Services has positioned itself as a disruptor. Competing against established players like HDFC, ICICI, and Bajaj Finance, JFS leverages its extensive digital infrastructure and customer base from Reliance Jio to offer innovative and accessible financial products.

SWOT Analysis:

- Strengths: Strong brand presence, extensive customer base, and financial backing from Reliance Industries.

- Weaknesses: High competition from established players and regulatory challenges.

- Opportunities: Expanding digital payments market, increasing financial inclusion in India.

- Threats: Regulatory risks, economic downturns, and market saturation.

2. Jio Financial Services Share Price Analysis

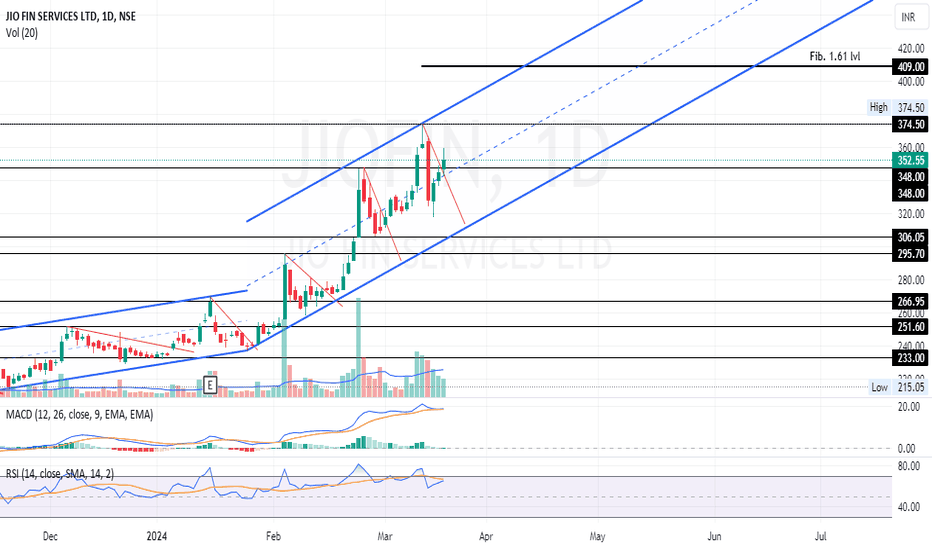

2.1 Historical Share Price Performance

Since its inception, the share price of Jio Financial Services has seen a dynamic trajectory. The stock was listed at a price of ₹204.65 and quickly climbed to a 52-week high of ₹394.70. This rapid appreciation reflects investor confidence and the market’s positive outlook on the company’s growth potential.

Key Milestones Influencing Share Price:

- Initial Public Offering (IPO): The company’s listing was met with high investor interest, leading to a strong debut on the stock exchanges.

- Strategic Partnerships: Collaborations with global financial giants like BlackRock have further boosted investor confidence.

- Quarterly Earnings Reports: Positive financial results have consistently driven up the share price.

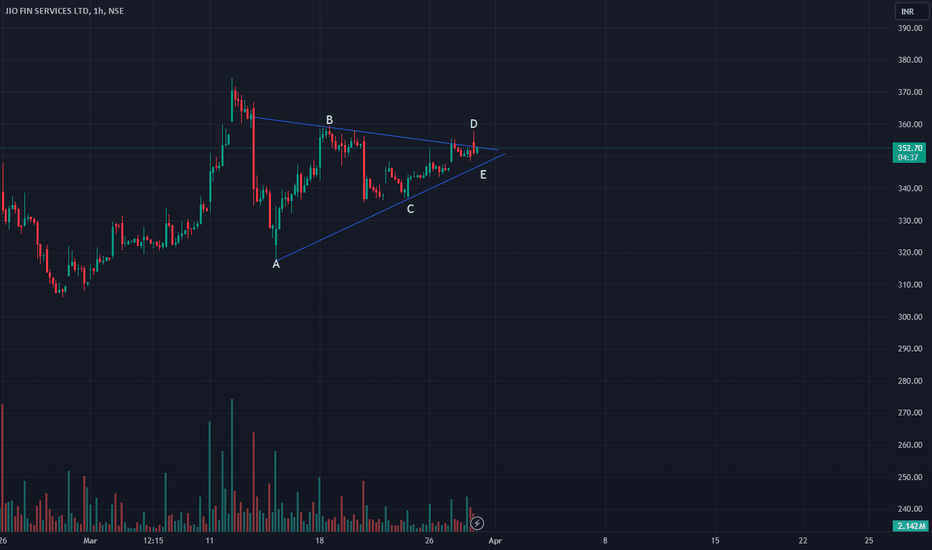

2.2 Recent Trends in Jio Financial Services Share Price

Over the past six months, Jio Financial Services’ share price has fluctuated due to various factors, including market sentiment, economic data releases, and company-specific news. Despite the volatility, the overall trend has been upward, driven by strong earnings and strategic initiatives.

2.3 Comparative Analysis with Competitors

When compared to other NBFCs and financial services companies in India, Jio Financial Services has outperformed many of its peers in terms of stock price appreciation. The company’s P/E ratio of 143.82 is significantly higher than the industry average of 17.11, indicating strong investor expectations for future growth.

Table: Comparative Analysis of Jio Financial Services and Competitors

| Company Name | Share Price (₹) | P/E Ratio | Market Cap (₹ Cr) | ROE (%) | Dividend Yield (%) |

|---|---|---|---|---|---|

| Jio Financial Services | 347.20 | 143.82 | 2,20,429 | 1.27 | 0.00 |

| HDFC Bank | 1,590.30 | 19.77 | 9,21,850 | 17.55 | 1.10 |

| Bajaj Finance | 6,920.55 | 23.15 | 4,19,125 | 19.89 | 0.20 |

| ICICI Bank | 973.80 | 24.02 | 6,78,550 | 16.12 | 0.70 |

3. Factors Influencing Jio Financial Services Share Price

3.1 Economic and Industry Factors

Macroeconomic conditions significantly influence Jio Financial Services’ share price. Factors such as GDP growth, inflation rates, and the Reserve Bank of India’s (RBI) monetary policy decisions play a crucial role in determining the stock’s performance. Additionally, the financial services industry itself is subject to changes in regulations, which can impact the company’s operations and profitability.

3.2 Company-Specific Factors

Several company-specific factors influence the share price of Jio Financial Services:

- Financial Performance: Strong earnings reports often lead to a surge in share price, as seen in the recent quarters where JFS reported a net profit of ₹1,604.55 crore.

- Strategic Initiatives: Partnerships, new product launches, and expansion into new markets can positively impact investor sentiment.

- Leadership Changes: Any changes in the company’s leadership can affect the stock price, as seen in other large corporations.

3.3 External Factors: Global Market Influence

Global economic trends, such as changes in oil prices, currency fluctuations, and international trade policies, can also impact Jio Financial Services’ share price. Being a part of the larger Reliance Group, which has significant exposure to global markets, JFS is indirectly affected by these external factors.

4. Investor Sentiment and Market Predictions

4.1 Current Investor Sentiment

Investor sentiment towards Jio Financial Services remains positive, driven by the company’s consistent financial performance and growth potential. High trading volumes and a favorable buy/sell ratio indicate strong market interest in the stock.

4.2 Expert Opinions and Analyst Ratings

Market analysts have given mixed ratings to Jio Financial Services, with some predicting further growth due to its strong fundamentals and strategic position. In contrast, others caution against the high P/E ratio, which could indicate an overvaluation. However, the general consensus leans towards a positive outlook, with a predicted share price trajectory that could see further appreciation in the next 12 months.

4.3 Investment Strategies for Jio Financial Services

For investors, Jio Financial Services presents both long-term and short-term opportunities. A long-term investment strategy could benefit from the company’s growth potential and expanding market presence. Conversely, short-term investors might capitalize on price fluctuations and trading opportunities. However, it’s crucial to consider the risks associated with high P/E ratios and market volatility.

5. Key Financial Metrics to Watch

5.1 Earnings Per Share (EPS)

Earnings Per Share (EPS) is a critical metric for evaluating the profitability of Jio Financial Services. The company’s EPS has shown growth, reflecting its ability to generate profits from its operations. Investors should monitor the EPS closely, as it is a key indicator of financial health and future performance.

5.2 Price-to-Earnings (P/E) Ratio

The P/E ratio of Jio Financial Services is currently 143.82, which is significantly higher than the industry average. This high P/E ratio indicates that investors are willing to pay a premium for the company’s future earnings potential. However, it also raises concerns about the stock being overvalued, which could lead to corrections in the share price.

5.3 Return on Equity (ROE) and Return on Capital Employed (ROCE)

ROE and ROCE are important metrics for assessing how effectively Jio Financial Services is utilizing its equity and capital to generate profits. While the company’s ROE is currently low at 1.27%, it is expected to improve as the company continues to grow and expand its operations.

Frequently Asked Questions

What drives the share price of Jio Financial Services?

Jio Financial Services’ share price is driven by factors like financial performance, market trends, strategic initiatives, and macroeconomic conditions, including RBI policies and global economic influences.

How does Jio Financial Services compare to other NBFCs in India?

JFS competes with NBFCs like HDFC and Bajaj Finance, excelling in digital innovation but with a higher P/E ratio, reflecting future growth expectations and a strong market position.

Is Jio Financial Services a good long-term investment?

Jio Financial Services offers strong long-term potential due to its market positioning, growth strategies, and backing by Reliance Industries, though risks include high valuation and market competition.

Where can I track the share price of Jio Financial Services?

You can track Jio Financial Services’ share price on major financial news websites, stock trading platforms, and the BSE/NSE official websites, where live updates and historical data are available.

What are the risks associated with investing in Jio Financial Services?

Risks include high valuation (P/E ratio), market volatility, regulatory changes, and economic downturns, which could impact the company’s profitability and share price performance.

Conclusion

Jio Financial Services has quickly emerged as a significant player in the Indian financial services sector, backed by the strength and reputation of Reliance Industries. Its share price reflects the market’s confidence in its potential, with high investor interest and a strong growth trajectory. While the company’s current valuation is steep, driven by its ambitious expansion plans and strategic initiatives, it also poses certain risks that investors need to consider, such as market volatility and regulatory changes.

For long-term investors, Jio Financial Services offers a promising opportunity, especially as it continues to innovate and capture a larger market share in digital payments, insurance, and lending. However, it is essential to stay informed about market trends and company-specific developments to make well-informed investment decisions. Monitoring key financial metrics like EPS, P/E ratio, and ROE will help in assessing the company’s ongoing performance and potential for future growth.

Bonus Points

Strategic Partnerships: Jio Financial Services has established key partnerships, such as with BlackRock, to enhance its offerings and expand its market reach. These collaborations could drive future growth and positively impact the share price.

Technological Innovation: Leveraging Reliance’s digital infrastructure, Jio Financial Services is at the forefront of fintech innovations in India. This technological edge can help the company offer unique products and capture a larger customer base.

Market Expansion: As the financial services sector in India grows, Jio Financial Services is well-positioned to expand into underpenetrated markets, such as rural areas, where there is significant demand for financial products.

Resilient Leadership: With a strong leadership team, backed by Reliance Industries’ experienced management, Jio Financial Services benefits from strategic vision and execution, which are critical for navigating challenges and seizing opportunities.

Investor Confidence: The high level of investor interest and trading volumes indicate strong market confidence in Jio Financial Services. This momentum can sustain share price growth, especially if the company continues to deliver on its financial and strategic goals.